Taxfix Review: The Best Way to File Your Taxes in Germany

This page takes an in-depth look at Taxfix, a digital tax app for completing your annual tax return in Germany. We cover who Taxfix are, what they offer and why they are a perfect choice for securing a tax refund while you are working and living in Germany.

Taxes are complicated, scary and hard at the best of times. When you add in endless German tax terms, lengthy tax declaration forms and overworked tax office staff, you can begin to feel defeated and lost before you have even started with your annual tax return.

Fortunately, there is a quick fix to your tax headaches in the form of Taxfix. Formed in 2017 and headquartered in Berlin, Taxfix is fast establishing itself as the leading digital tax assistant in Germany having just consolidated its position with a $65 million Series C funding round.

The outlook for Taxfix is promising. Germany’s convoluted tax system means that billions of euros are left unclaimed each year. By combining a user-friendly app with smart tech, Taxfix is working to replicate and automate the expensive services of a tax accountant, in the process helping thousands of employees in Germany submit optimised tax declarations and receive the tax return that they are owed.

The problem with taxes in Germany

As its name suggests, Taxfix believes that the tax return system in Germany needs fixing. But what exactly is the problem? Well, the fundamental problem is that millions of employees in Germany are left with 3 poor options when it comes to filing their annual tax declarations:

Hire a professional. Hiring a German tax advisor (Steuerberater) does not come cheap. For an annual tax declaration, you can expect to pay a tax advisor €300–€700. This means that a large portion (if not all!) of your tax refund will be gobbled up by your Steuerberater.

Go it alone. You can battle through the tax return forms on your own. The forms are long and only in German. Without a decent understanding of both German and taxes, this will take you hours and your chances of submitting an optimised return are slim, meaning you will only receive a fraction of the money you are entitled to.

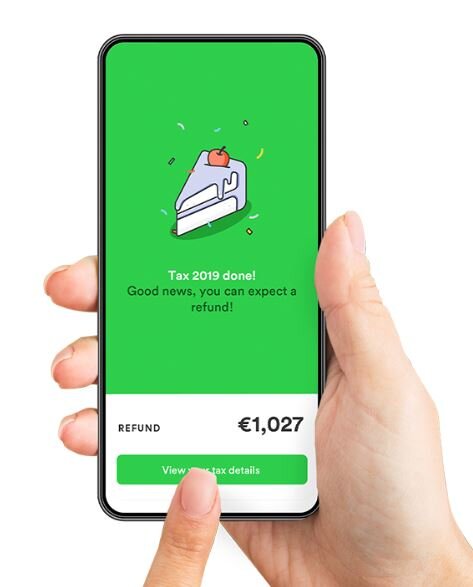

Do not file a tax return. The options above are either expensive or time-consuming. Due to this, around 20% of employees in Germany opt to not submit an annual tax return whatsoever. By opting not to submit an annual tax return, each employee is giving up an average tax refund of €1027. This is a decent chunk of change being left on the table at the end of every year!

This is the broken system that Taxfix is working to address. So, how do they do this?

The Benefits of Taxfix

Taxfix has created a super-intuitive and slick tax-filing app that functions as your digital tax accountant. Having used the app personally, we can confirm that it goes above and beyond the company’s mission to simplify the complex German tax system.

What we love about the Taxfix app:

User-friendliness

The Taxfix app is so simple it is virtually foolproof. The tax return process in the app involves a set of conversational questions that require no expert tax knowledge or German language skills. You can expect around 70 questions, which is all Taxfix needs to create your optimised tax return.

When you consider the complexity of tax regulations in Germany, Taxfix’s simplification of the tax return process makes it accessible to all employees in Germany, not just those with the money, time or knowledge to do their returns through more traditional methods.

Transparency

Once you have answered the relevant questions in the Taxfix app regarding your work, income, health status, etc. you will be shown your estimated tax refund.

Price

Using the Taxfix app and receiving your tax refund estimate is completely free. The only cost you will incur is a €39.99 flat fee for submitting your tax return to your local tax office (Finanzamt) via the app.

At €39.99, this is only around 10% of what you would be paying for even the cheapest tax advisor on the market.

Speed

On average, it takes just 22 minutes to submit your tax declaration through the Taxfix app. This is especially speedy when compared to the 6-hour average it takes to submit your tax return if completing the paperwork on your own.

Great returns!

If preparing your tax return documents and transmitting them to your local tax office (Finanzamt) was not enough, Taxfix helps ensure you are refunded what is rightfully yours. On average, each taxpayer receives €1027 from their annual tax declaration.

Every year, Taxfix’s technology is getting smarter, allowing for continued optimisation of taxpayer declarations and higher tax refunds as a result.

The Drawbacks of Taxfix

If you had not noticed already, we are big fans of Taxfix. The fact that it is difficult to find negatives regarding the app is a testament to its quality. However, if we were to mention one, it is that Taxfix is:

Primarily limited to regular employees in Germany

While Taxfix is a fantastic tax-filing tool for employees in Germany, the app currently does not offer support for freelancers, self-employed workers, tradespeople or pensioners.

How to complete your German tax return with Taxfix

Taxfix provides a straight-forward process for submitting your tax return that can be broken down into 5 steps.

Step 1: Open the Taxfix app and answer tax-related questions

Answer approximately 70 questions covering your living situation, income, home life, work, health and finances. Taxfix will only ask for the data it needs to complete your tax return.

Step 2: Scan or upload your annual wage and tax statement to the Taxfix app

At the end of the financial year, your employer will provide you with an annual wage and tax statement, known as a Lohnsteuerbescheinigung. This statement details all the essential info for your tax return, including the duration of your employment, your salary, the income tax that has already been withheld, church tax payments, etc.

The Taxfix app will automatically extract the relevant data from your Lohnsteuerbescheinigung and transfer it to the relevant parts of your tax declaration forms.

Step 3: See your estimated tax refund

Once you have answered the questions that are relevant to your German tax return and uploaded your annual wage and tax statement (Lohnsteuerbescheinigung), you will see your estimated tax refund in the Taxfix app.

Step 5: Receive your tax refund directly to your bank account

Approximately 6–12 weeks after submitting your tax return via Taxfix, you can expect to receive your tax return in your bank account. On average, taxpayers get a refund of €1027 – not bad for 22 minutes of work!

If all of this sounds too good to be true, then try it for yourself! Sign up for Taxfix via this link and discover exactly how big a refund you are due. Remember, getting an estimated tax refund calculation is entirely free via the Taxfix app – you will only pay a small flat fee of €39.99 if you choose to proceed with the tax refund.

We hope you have found this post helpful and that it helps you with filing your taxes in Germany. In our opinion, using Taxfix is a no-brainer and we are excited to see the company expand into different areas of personal finance.

For further information about living in Germany, see our other blog posts and free relocation resources. If you are interested in moving to Berlin specifically, then you may also be interested in our relocation guides on our homepage.