Best Bank in Germany: An Overview

This page focuses on the best banks in Germany for expats. From the sign-up process and bank fees to features and customer support, we have compared how Germany’s banks match up and detailed the various pros and cons of the different options.

When moving to Germany, it is very important to have (preferably free!) access to your funds. There are few things more frustrating than incurring expensive bank transaction fees, ATM charges, and delays in money transfers.

On top of this, having a German bank account is often an important requirement for renting an apartment, signing up for a phone/internet package and getting paid by your employer. As such, setting up a German bank account as soon as possible is definitely a priority when moving to Germany!

In Germany, there are a number of traditional banking options as well as an array of modern online banks. We have profiled a number of these below, highlighting their respective pros and cons to give you a clear idea of which is the best bank in Germany for your situation.

⚠️ As this page is geared towards newcomers to Germany, we have only focused on banks that offer some degree of English-speaking support and services.

For other banking options that are predominantly in German, and therefore not so well geared for the expat market, see the ‘Other Banking Options’ section below.

Not in Germany yet or do not have an address in Germany?

Before you can sign up for a German bank account, you need a German address. However, when first arriving in Germany, you may not initially have an address but will likely still need immediate access to your funds at a decent exchange rate.

💰 For this, we really like Wise’s borderless account, formerly TransferWise. Signing up for a Wise account and bank card before arriving in Germany means you can benefit from extremely low fees when transferring your money to euros, withdrawing cash or making payments on your Wise Debit Card once in Germany.

This is a great temporary measure prior to getting set up with a German bank account and will work out far cheaper than initially using your home bank card in Germany.

Our Assessment Criteria

When determining the best bank in Germany, we have based it on a number of factors that have allowed us to weigh up the pros and cons of different options. These options include:

✔️ English-speaking customer support

✔️ The sign-up process

✔️ Bank fees

✔️ ATM fees

✔️ Card type

✔️ Banking Features

As in any country, there is no perfect bank, but we have tried to provide a transparent overview of the most important factors for expats looking for a suitable bank in Germany.

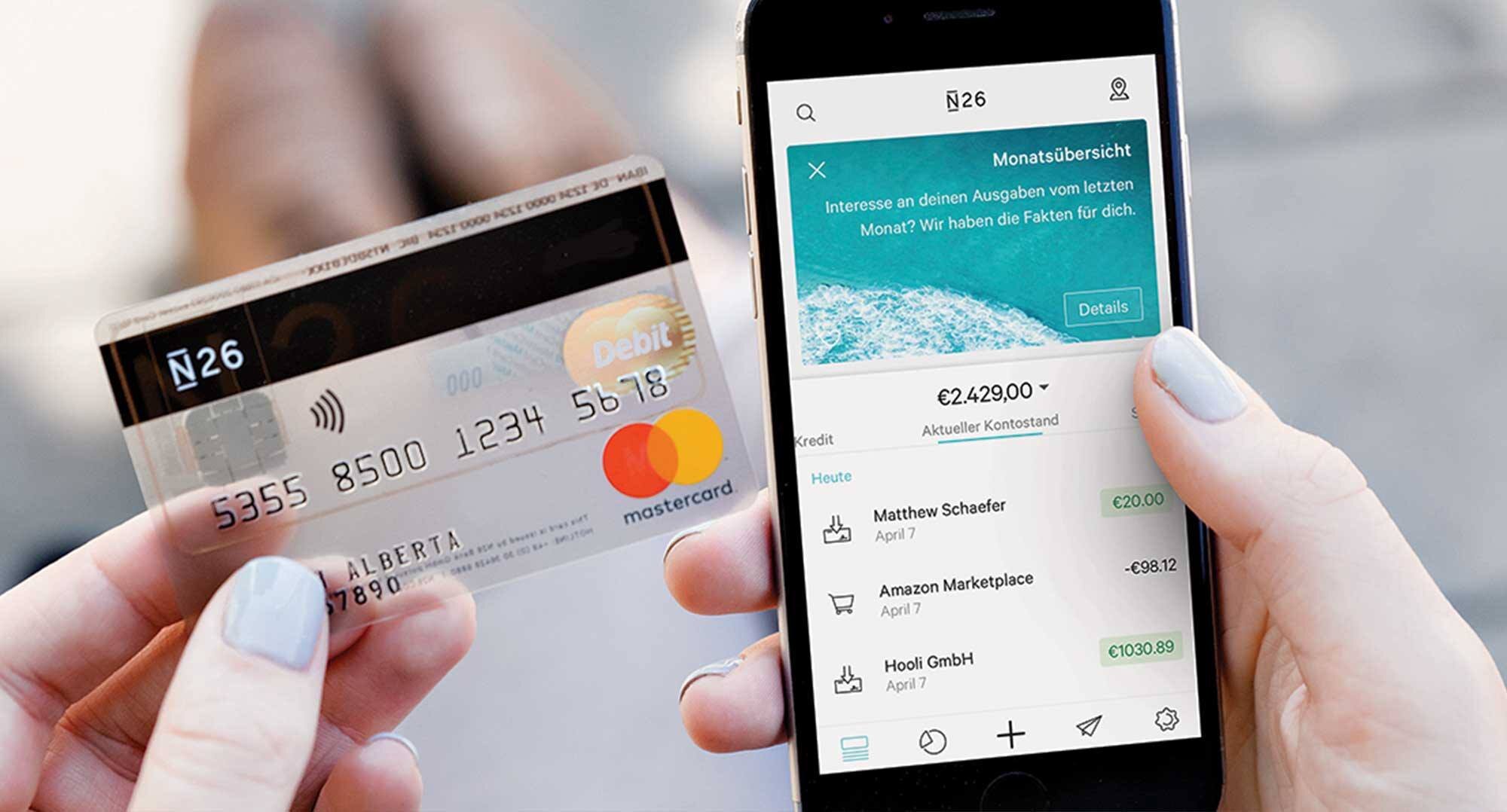

1️⃣ N26 – Overall score: 9/10

Where better to start than with our favourite bank in Germany; N26. N26 has gone from strength to strength in the past few years, graduating from being a disruptive startup to an established player in the German banking sector.

✅ English-speaking customer support: 8/10

N26 is considered to have the most English-friendly customer support among German banks. The bank’s website, communications and customer support are solely in English and their chat function is available 24/7 every day of the year.

As an online bank, N26 does not have any branches and does not offer the option of speaking to someone face-to-face, but we feel this is a minor drawback considering the extent of their online support.

✅ The sign-up process: 9/10

N26 offer a quick, online sign-up process that is entirely in English. Once you have completed the online verification, you will receive your bank card in the post after approximately one week, at which point you are all set! For more detailed instructions on how to sign up, see here.

Importantly, you can sign up for an N26 account before you are officially registered at an address in Germany, a process that is known as Anmeldung. This is not possible with most German bank accounts.

One drawback is that IDs from certain countries are not accepted, meaning you are not able to open an account. For Germany, here is an overview of which ID documents you need to show to open an N26 account.

✅ Bank fees: 10/10

N26’s standard bank account is completely free to set up and maintain and includes zero monthly fees.

They have a couple of more advanced accounts that charge a monthly fee (N26 You and N26 Metal), but for most expats, the standard N26 account is sufficient.

✅ ATM fees: 6/10

N26 offer 5 free ATM withdrawals per month if you are under 26 or have at least €1,000 coming into your account per month or receive your salary, student allowance or benefits in your N26 account.

Otherwise, you will only have 3 free ATM withdrawals per month after which a €2 fee is incurred. If you are withdrawing money outside of Germany, you will incur a 1.7% fee on the total amount withdrawn.

✅ Card type: 10/10

All N26 accounts include a free Debit Mastercard. Surprisingly, this is not all that common in Germany as most accounts only include a girocard or Maestro, both of which have more limited functionality than a debit card, especially online and internationally.

With an N26 account, you can also order a free Maestro card to use alongside your Debit Mastercard, meaning you will have all bases covered!

✅ Banking features: 8/10

All your banking services can be managed through N26’s sleek and intuitive app, which combines great design, smooth functionality and some great features – all of which allow expats to manage their finances with relative ease while living in Germany. Better still, N26 has integrated Wise (formerly TransferWise) directly into its app so you can make fast and affordable international transfers.

✏️ Summary of N26

Marketed as Europe's first mobile bank, N26 allows you to manage your entire financial life on your phone. Its free Debit Mastercard, free ATM withdrawals, intuitive app and English-speaking customer service are unparalleled in Berlin. When coupled with the fact that there are no hidden fees and you can sign up online in just a few minutes, this is our favourite banking option in Germany.

For a more extensive assessment of N26, see our N26 review.

2️⃣ Vivid Money – Overall score: 8.5/10

Vivid is the newest challenger bank on the market and is set to be a competitive player amongst more established disruptors in the German banking sector.

✅ English-speaking customer support: 8/10

Vivid Money offers 24/7 personal support with a real customer representative. You can contact them in English or German at any time via the in-app chat function or by emailing them at support@vivid.money.

The bank has no branches and operates entirely online, which will be considered a drawback by some users.

✅ The sign-up process: 9/10

As with all modern, challenger banks, Vivid Money prides itself on its usability. With this in mind, they have created a user-friendly, quick and intuitive sign-up process that can be completed with just your phone.

The first step is to download the Vivid Money app here, after which you will need to verify your identity via Vivid’s video or photo verification process.

✅ Bank fees: 9/10

Vivid Money's standard account is 100% free to set up and maintain.

A neat feature of the account is that you can split your money into 15 sub-accounts or ‘Money Pockets’, each with its own IBAN. You can keep different currencies in different sub-accounts, effectively transforming your German bank account into a multi-currency account that can be used all around the world. Better still, you receive a live exchange rate when moving currencies between ‘Money Pockets’.

They also offer a Vivid Prime account that is free for the first 3 months after which it costs €9.90 per month.

✅ ATM fees: 5.5/10

If you are a heavy cash user, then ATM fees are possibly the biggest drawback of Vivid Money. Notably, the Vivid Standard account only allows €200 in free cash withdrawals per month (€1000 per month for the Vivid Prime account). You will incur a 3% fee on withdrawals above this amount.

✅ Card type: 10/10

All Vivid Money accounts come with a free metal Visa debit card. This gives you complete flexibility to pay for what you need to in Germany, whether online, in-store or out and about.

A cool security feature is that your Vivid Money bank card actually has no personal data on it. Your card number, card expiry date, CVV security code, etc. can all be found in the app so the risk is minimal if you lose your card.

✅ Banking features: 8/10

As with N26, Vivid Money has a slick app that fulfils most of your day-to-day banking needs – from making transfers and changing your PIN to blocking your card and tracking your money, the Vivid app has the necessary functionality.

But we think there are two standout features that set Vivid apart:

Cashback programme

Vivid offers up to €20 a month in cashback with the Vivid Standard account (€100 a month with the Vivid Prime account) when spending money at some popular companies and brands, including Lieferando, REWE and HelloFresh as well as subscription services such as Netflix and Amazon Prime Video.

Trading and investment functionality

Vivid is integrating investment tools into their app, allowing you to invest in EU and US stocks or ETFs either commission-free or at a very low cost.

More recently, Vivid has also entered the cryptocurrency market – through your Vivid account, you can invest in all the major crypto coins including Bitcoin, Ethereum and Litecoin.

✏️ Summary of Vivid Money

While N26 has a clear head start amongst the German challenger banks, we are excited by the arrival of Vivid Money in the German banking sector.

With meaty financial backing, a solid product and a three-pronged approach covering banking, savings and investments, it promises to become an increasingly attractive option for newcomers to Germany.

Still undecided? Read our more comprehensive review of Vivid Money here.

3️⃣ bunq – Overall score: 8/10

Hot on the heels of N26 and Vivid Money is bunq, another online bank that is disrupting the European banking sector and a decent option for expats moving to Germany. See why we have rated bunq as the on of the best banks in Germany below.

✅ English-speaking customer support: 8/10

As with most modern startups, bunq offers customer support in English (+5 other European languages). Support is generally offered via email, a chat function in the app or notifications. Interestingly, bunq has a thriving user community called ‘bunq Together’ that is a useful source of support.

The bank has no branches and operates entirely online, which will be considered a drawback by some users.

✅ The sign-up process: 9/10

The bunq sign-up process is an incredibly simple one that can be completed in a matter of minutes – all you will need is your phone, ID and address.

Once verified, your card should arrive in the post within 10 days although you can start using bunq’s online banking services before this.

✅ Bank fees: 5/10

bunq’s standard bank account (Easy Money account) costs €8.99 per month. Handily, this account allows you to set up 25 separate IBAN accounts to manage your money.

✅ ATM fees: 7.5/10

bunq offers 4 free ATM withdrawals per month. Subsequent withdrawals are charged at €0.99 per withdrawal.

✅ Card type: 10/10

bunq accounts include both a free Debit Mastercard and Maestro. This gives you complete flexibility to pay for what you need to in Germany, whether this is online purchases, restaurant meals or your weekly shopping.

✅ Banking features: 8/10

As with other modern online banks, bunq has a polished, intuitive app that allows you to manage all your banking needs via your mobile. With just a few taps on your phone, you can make payments, change your PIN, block your card, tracks your finances, and much much more.

As with N26, bunq has integrated Wise (formerly TransferWise) directly into its app so you can make fast and affordable international transfers.

✏️ Summary of bunq

bunq is among the top up-and-coming online banks that are making waves in the German banking sector. While it matches N26 in most departments, the monthly fee makes it slightly less appealing for expats on a budget.

For a more extensive assessment of bunq, see our bunq review.

4️⃣ Commerzbank – Overall score: 7/10

If you are requiring a more extensive range of banking services and in-branch support, then Commerzbank Bank is a good, traditional banking option in Germany.

✅ English-speaking customer support: 5/10

While the majority of communications and policy documents from Commerzbank are in German, they do offer an English version of their website, which lays out their different products and services for private and business banking.

They also offer English online banking.

As with Deutsche Bank, Commerzbank offers in-branch support, and most of the branches should have at least one English speaker in their midst.

✅ The sign-up process: 6/10

To sign up for a Commerzbank account, you must first have completed your address registration (Anmeldung) in Germany.

You can sign up for an account either online or in a branch. If signing up online, the sign-up form is entirely in German so can be awkward and confusing for non-German speakers.

The best option is instead to sign up for a Commerzbank account via an in-branch appointment. Here you can usually open an account on the spot upon presentation of your passport and address registration certificate (Anmeldebestätigung).

✅ Bank fees: 7/10

Commerzbank’s standard current account is free if you have at least €1200 coming into the account per month. Otherwise, you will be charged €9.90 per month.

✅ ATM fees: 5/10

With Commerzbank, you only get free ATM withdrawals from ATMs owned by the ‘Cash Group’, which includes Commerzbank, Deutsche Bank, HypoVereinsbank, and Postbank (and their subsidiaries). These only make up a small proportion of ATMs in Germany, which can make it tricky to avoid fees.

If you withdraw money from an ATM that does not belong to the ‘Cash Group’, you will incur a €5–6 fee per withdrawal.

✅ Card type: 6/10

Commerzbank’s current account only comes with a free EC Card (EC-Karte). An EC Card has limited functionality and is mainly used for withdrawing cash at ATMs and point-of-sale transactions. You can rarely use an EC Card to make online payments, e.g. booking flights and holidays or purchasing products in online stores.

If you would also like a Debit Mastercard, this will cost you €39.90 per year.

✅ Banking features: 8/10

Commerzbank offers a full suite of traditional banking services. Whether you just want a standard current account or are more interested in saving, borrowing or investing, Commerzbank will definitely have something to offer you.

✏️ Summary of Commerzbank

For most expats, Commerzbank’s more comprehensive services only become relevant if staying in Germany longer term. Therefore, we suggest starting with N26, bunq or Vivid and then joining Commerzbank as and when you can benefit from their traditional banking services.

5️⃣ Deutsche Bank – Overall score: 6.5/10

Rounding off our list of the best German banks that offer English-speaking services is Deutsche Bank. Similar in its offering to Commerzbank, Deutsche Bank is another solid choice if you are after more traditional banking services in Germany than that offered by online banks such as N26, Vivid and bunq.

✅ English-speaking customer support: 7/10

While most of the written communications from the bank are in German, Deutsche Bank does offer online banking services in English. Having used Deutsche Bank’s online services personally, I can confirm that their English online banking system is relatively self-explanatory and easy to use.

Unlike N26, Vivid and bunq, Deutsche Bank also offers in-branch support. Most German branches will likely have some English-speaking staff members that can assist non-German speakers.

✅ The sign-up process: 6/10

To sign up for a Deutsche Bank account, you must first have completed your address registration (Anmeldung) in Germany.

While you can sign up for a Deutsche Bank account online, the process is entirely in German and not easy for non-German speakers to navigate.

The better option is to sign up for an account at a Deutsche Bank branch. Here you can usually open an account on the spot upon presentation of your passport and address registration certificate (Anmeldebestätigung). Deutsche Bank has a useful online tool to help you find your nearest branch.

Once you have signed up, you will then receive 4/5 different letters, including your bank card, bank pin, online banking details, phone TAN, etc. This can be quite cumbersome and inconvenient, especially if you are in short-term accommodation and not staying long enough in one apartment to receive all the letters. This is a big drawback when compared with N26, bunq and Vivid, which offer immediate functionality through their app and then quickly deliver your bank card.

✅ Bank fees: 7/10

Deutsche Bank’s standard bank account (AktivKonto) costs €5.90 per month.

✅ ATM fees: 5/10

With Deutsche Bank, you only get free ATM withdrawals from ATMs owned by the ‘Cash Group’, which includes Deutsche Bank, Commerzbank, HypoVereinsbank, and Postbank (and their subsidiaries). These only make up a small proportion of ATMs in Germany, which can make it tricky to avoid fees.

If you withdraw money from an ATM that does not belong to the ‘Cash Group’, you will incur a €5–6 fee per withdrawal - ouch!

✅ Card type: 6/10

Deutsche Bank’s standard account (AktivKonto) only comes with a free EC Card (EC-Karte). An EC Card has limited functionality and can mainly be used for withdrawing cash at ATMs and point-of-sale transactions. You can rarely use an EC Card to make online payments, e.g. booking flights and holidays or purchasing products in online stores.

If you would also like a Debit Mastercard or VISA, this will cost you €39 per year with Deutsche bank.

✅ Banking features: 8/10

Deutsche Bank offers all the features you would expect from a traditional bank. While not as convenient as N26, Vivid and bunq for your day-to-day transactions, Deutsche Bank offers far more opportunities when it comes to savings, investments, credit, real estate financing, etc.

✏️ Summary of Deutsche Bank

While similar to Commerzbank in its offering, Deutsche Bank is arguably slightly less geared towards expat customers. Having browsed their materials extensively, we found them to be the most ‘German’ of our five best banks in Germany.

For day-to-day use, the monthly account fee combined with only being able to use a limited number of ATMs are notable drawbacks for Deutsche Bank.

Other Banking Options in Germany

As a newcomer to Germany, we suggest you opt for one of the five options above as you will have access to either comprehensive English customer support (N26, Vivid or bunq) or at least partial English customer support (Commerzbank and Deutsche Bank).

From experience, I can tell you that it is extremely frustrating not being able to communicate properly about your finances, especially if you cannot access your funds or have had your bank card stolen. Do not underestimate English-speaking customer support when it comes to your money!

However, if you are interested in some of the more ‘German’ banking options, here are some popular choices:

1️⃣ DKB – Deutsche Kredit Bank

Amongst German speakers, DKB is a popular choice of bank. Operating entirely online, DKB’s standard account is free to set up and maintain, comes with a free Visa debit card, and offers free ATM withdrawals in Germany, the EU and worldwide.

If you have intermediate German skills, then DKB is an attractive offering with solid functionality, intuitive interfaces and services to cover all your day-to-day banking needs.

Check out our DKB blog post to find out more, including an English-speaking guide to opening a DKB account.

2️⃣ ING

3️⃣ Sparkasse

4️⃣ Comdirect

5️⃣ Postbank

Blocked account / Sperrkonto

The suggestions above are based on standard current accounts used for day-to-day banking in Germany.

👩🎓 However, for certain visas for Germany, you actually need to have your funds in a special type of account in order to be approved for the visa. This account is known as a Sperrkonto (blocked account) and is mostly only relevant if you are applying for a Student Visa or German Language Visa and need to prove that you have sufficient funds to live in Germany.

When it comes to blocked accounts in Germany, we like Fintiba. You can open a Fintiba account from overseas and it is a quick online process with relatively low fees compared to the other banks that offer this type of account. The fee is €89 to open the account and €4.90 per month thereon.

Check out our guide on opening a blocked account in Germany, including step-by-step sign-up instructions for a Fintiba account.

Receiving bank mail in Germany

📪 In Germany, almost all mail is delivered by name rather than apartment number. Therefore, it is crucial that your name is on your letterbox at your apartment.

Once you have signed up for a bank, you will receive your bank card (and any other bank-related documents) in the post.

If your name is not on the letterbox of your apartment, then you need to indicate that your mail is in the 'care of' someone. To do this, you need to put C/O followed by the name of the person on the letterbox and then your name and address. Or C/O followed by the name of the accommodation provider.

Here are two examples:

C/O Mary Westermann

Susan Smith

124 Karl Marx Allee,

Berlin

C/O Berlin Apartments

Susan Smith

10 Schönhauser Allee,

Berlin

✅ We hope you have found this rundown of the best banks in Germany useful. For further tips on moving to Germany, check out our homepage and free relocation resources.