N26 Review: How to Open a Free N26 Account

In this blog post, we review N26, an increasingly popular bank among expats living in Germany. As well as providing a comprehensive review of N26, we also provide step-by-step instructions for opening a free N26 bank account.

You have packed your bags, jumped on a plane and just touched down in Germany. You head to the nearest ATM as you need cash to get a cab from the airport. Here, reality strikes! A shoddy exchange rate is accompanied by a €5 ATM fee. Your home bank then adds a fee for withdrawing money overseas, rubbing further salt into the wound. And you only withdrew €60 meaning you will need to repeat the process in a couple of days – while relatively minor, this experience is an all too common and sobering experience for expats arriving in Germany. Your hard-earned savings are already being flittered away.

You need a banking solution in Germany, and you need it fast. Step up N26, our favourite banking option for expats arriving in Germany. While there are a large number of traditional ‘bricks and mortar’ banks in Germany, most expats need a bank that offers quick sign-up with minimal paperwork, low fees (if any!) and English-speaking customer support. Germany’s financial giants, including Deutsche Bank, Commerzbank, Sparkasse and Postbank, simply do not meet these criteria.

If you are interested in exploring your other banking options in Germany, see our comparison of the best German banks or our Vivid and bunq reviews, both good alternatives to N26.

In this N26 review, we will look at why it is turning the German banking sector on its head, in the process transforming a wave of young expats into die-hard converts of the bank. We will also review N26’s main features and show you exactly how to sign up so you can stop being plagued by banking issues and start enjoying your new life in Germany.

Quick Sign Up

Verify your ID

Receive your N26 Debit Mastercard in the post

N26 Review: “The Bank You’ll Love”

N26 is a 100% online bank that allows you to manage your bank account from your smartphone

Since its inception in 2013, N26 has experienced meteoric growth. Similar in concept to Vivid, the Berlin-based startup has amassed over 5 million users to date across 25 European markets. With over 1500 employees and offices in Germany, the US, Brazil, Spain and Austria, the online bank has earned its position in the top ten most valuable FinTech companies in Europe.

Crucially for expats living in Germany, N26 partners with Wise (formerly TransferWise), integrating the money transfer service directly into its app. What does this mean for you? It allows you to send 19 different currencies at real exchange rates, which ultimately works out up to 6x cheaper than transferring money via traditional banks.

Through combining this international functionality with a sleek and user-friendly app and branding, it is no surprise that expats are signing up for the German online bank in their droves.

N26 Review: What N26 Can Offer You

N26’s figures and growth are clearly impressive, but does the online bank really offer you what you need? As part of this review of N26, we will now take a look at some of the bank’s best features that make it the number 1 choice for many expats moving to Germany.

1. Opening and maintaining an N26 account is completely free

N26’s standard account is completely free. While many German banks charge roughly 5 euros a month for their standard account, N26 will charge you precisely nothing. On top of this, there is no charge to open the account, meaning there is no financial blowback or risk involved with signing up for an N26 account.

If you are wanting a more advanced N26 account for private banking, then there are two further bank account options:

The N26 You account is available for €9.90 per month

The N26 Metal account costs €16.90 per month

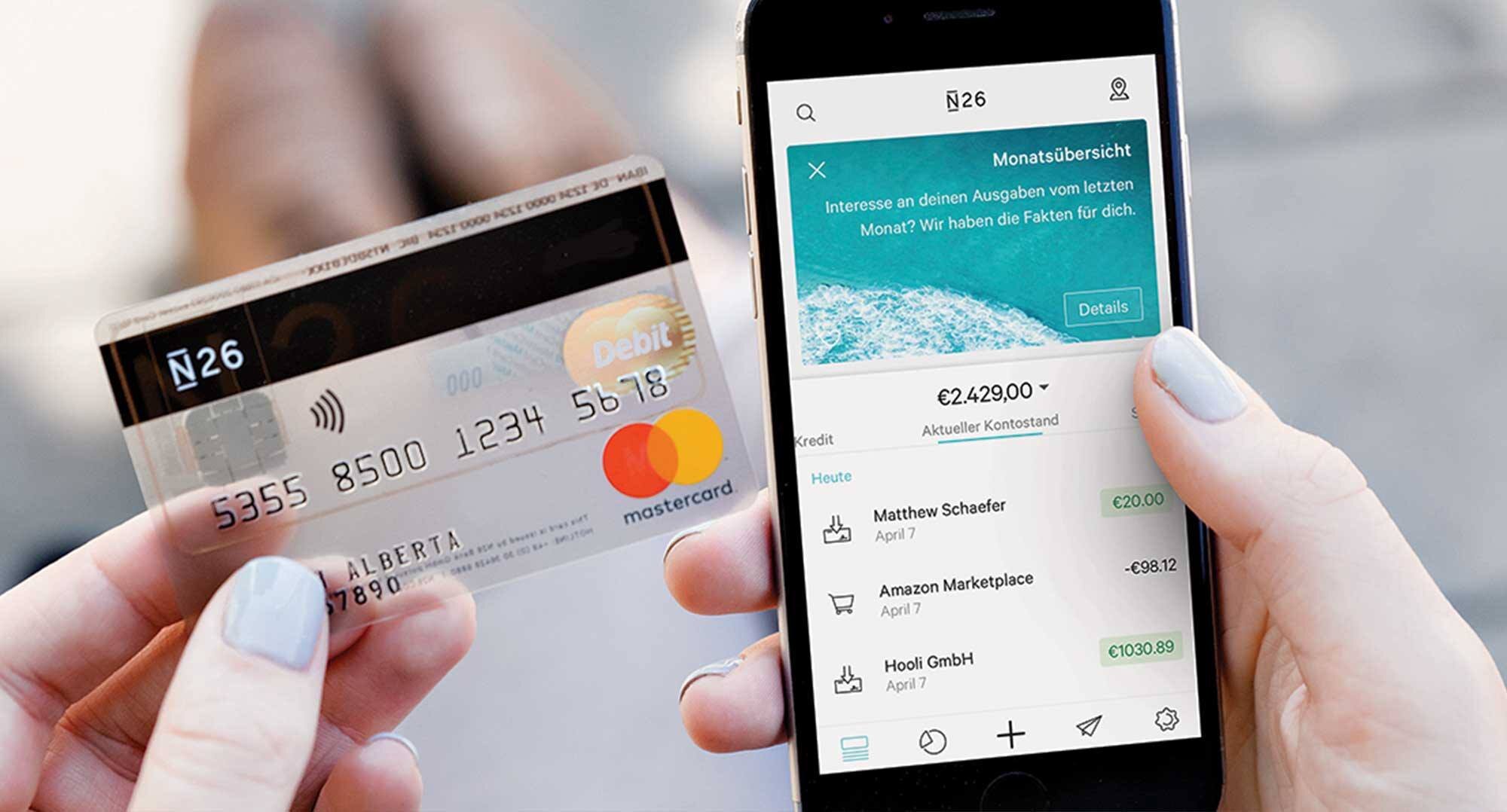

2. N26 Card: The standard account comes with a free Debit Mastercard

Receiving a free Debit Mastercard in Germany must not be underestimated! Most German banks only offer a free EC card with their standard accounts, with an annual fee (usually around €30) for a Debit card. The problem with an EC card is its limited functionality – while you can pay using an EC card in stores or restaurants and withdraw from ATMs, you cannot make purchases online or make certain reservations. This leaves you unable to book flights, hire rental cars or even purchase clothes online.

With N26’s Debit Mastercard, you receive all the functionality that an EC card is missing completely free of charge.

3. Free ATM withdrawals in Germany

Within Germany, N26 offers 3–5 free ATM withdrawals per month, with a €2 fee for any additional withdrawals. This allows you to withdraw from any ATM in Germany free of charge.

This is quite different from how other banks in Germany operate. For example, if you have a Deutsche Bank account and withdraw money from a Sparkasse ATM, you will incur a €5–6 fee. This applies for most banks in Germany, where you only receive free withdrawals if withdrawing from their dedicated ATMs or ATMs that belong in their ‘cash group’. By opting for N26, you avoid this scenario and can enjoy free ATM withdrawals across the country.

So far, we have established that N26 offers a free account, a free Debit card and free ATM withdrawals. And this is one of the main reasons we think N26 is a great option for newcomers to Germany – the core banking services are free!

4. English-speaking customer support

N26 is by far the most English-friendly banking service in Germany. The bank’s customer support and communications are entirely in English, making them the ideal banking partner for non-German speakers living in Germany. N26’s chat function is available 24/7 and 365 days of the year.

5. You do not require a registered address (Anmeldung) in Germany

Most banks in Germany require that you complete your address registration (Anmeldung) in Germany before you can sign up for one of their accounts. This is not the case with N26, who allow citizens of most countries to sign up without address registration in Germany.

6. Intuitive & User-Friendly Mobile App

While the big, burly, old-school banks have limped into the digital age, N26 is the epitome of a smooth, slick FinTech startup. In particular, the smartphone app has some great features, including:

MoneyBeam – this is my favourite feature allowing you to instantly send money to other N26 account holders. You do not even need their bank details, just their mobile number. As the transfers are instant, it is a great way of quickly repaying friends after a meal or holiday and is obviously much quicker than making an IBAN transfer.

CASH26 is another nifty feature is that allows you to deposit and withdraw money for free at over 11,000 retailers in Germany, including REWE, Rossmann, Penny, etc. While you can withdraw cash for free as many times as you want, only the first €100 deposited each month is free, after which there is a 1.5% fee on any amounts above that. This is particularly important to bear in mind if working a cash-in-hand job and needing to frequently deposit reasonable sums of cash.

Push Notifications – N26 will send your phone a notification when there is a transaction on your account. I find this super useful for keeping tabs on my spending and I’m immediately alerted if anything unexpected happens with my account.

Cash Map – if you’re out and about and need to locate the nearest cashpoint, then N26s Cash Map is a really useful tool. Just click on the location icon in the top right-hand corner of the app and the Cash Map will show a large array of available ATMs in Germany.

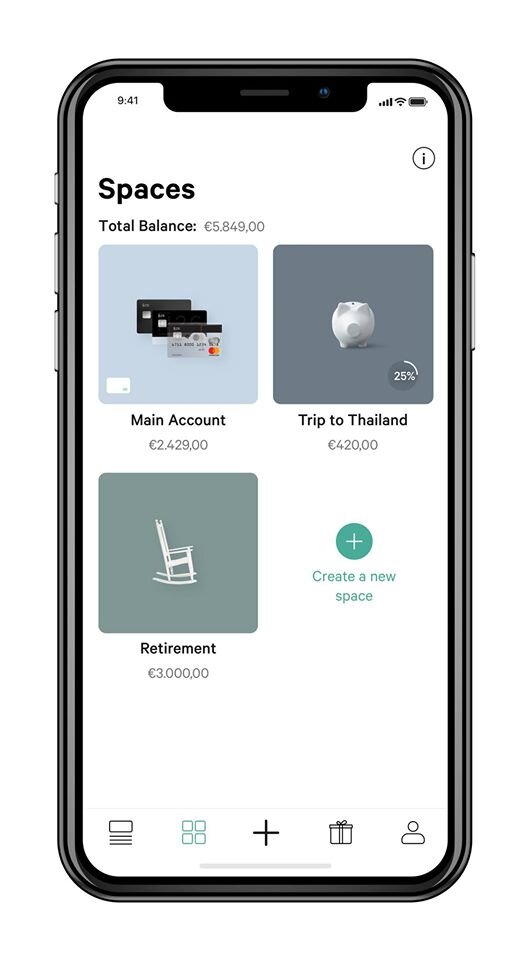

N26 Spaces – with N26 Spaces, you can create sub-accounts for organising your money or saving. For example, you may want to separate money for your tax return or a big purchase. The N26 Spaces feature allows you to clearly apportion funds, giving you an overview of exactly where you are in relation to your financial goals.

I hope this section has provided a clear review of N26 and its various features. While you will obviously never have a perfect bank, I feel that N26 ticks a lot of the boxes for expats moving to Germany.

If, after reading this review of N26, you are convinced that it might be the best option for you, then you can quickly register for an N26 account here and follow our sign-up instructions below.

N26 Review: How to Sign Up for an N26 Bank Account

So, you are ready to sign up for an N26 bank account. Firstly, you need to confirm your eligibility:

You must be over 18.

You must have a supported ID. For Germany, you can see what is considered a supported ID here. Note: certain countries require that you have a residence permit in order to be able to sign up for an N26 account in Germany.

You must not already have an N26 bank account.

You must be able to verify yourself in either German, English, French, Spanish or Italian.

Now you know you are eligible, here is how to sign up for an N26 account:

Step 1: Start the registration process via this link. Once on N26’s website, click ‘Open Bank Account’ and complete the online registration form.

Step 2: Connect your smartphone to your new N26 bank account.

Step 3: ID verification. If living in Germany, this is completed via a video call in the N26 app.

Step 4: Receive your N26 Debit Mastercard in the post after approximately one week.

Let us take a closer look at each step of N26’s sign-up process.

Step 1: Completing the online registration form for N26

By following this link and clicking Open Bank Account, you will be taken to N26’s online registration form. Here, you will be asked to enter the following information:

Personal Information:

Country of residence

First name

Last name

Email address

Date of birth

Phone number

Home address – this is where your N26 bank card will be sent. If your name is not on the letterbox of your apartment, then you need to indicate that your mail is in 'care of' someone. You can do this by adding 'c/o' and then the name that is on the letterbox at your apartment, e.g., 'c/o Westermann' (see picture below).

Additional Information:

Nationality (country)

City of birth

What is your legal sex?

Where are you tax liable?

Once you have provided this info, you will be requested to create the account by creating a password and agreeing to N26’s terms and conditions. N26 will then request that you confirm your email, after which you can log in to your N26 account online and choose a bank account type.

Step 2: Connecting your smartphone to your account

To use an N26 bank account, you must have a smartphone. If you have an iPhone, this must be an iPhone 5S or newer and have iOS11 as a minimum. If you use an Android, you must have Android 6.0 or newer.

You will be requested to connect your smartphone when you first load up the N26 app on your phone. Here you will be asked to confirm your number via a 4-digit code that will be sent to your phone by N26.

Step 3: Verifying your ID with N26

Now that you have completed your online registration, you need to prove your identity to N26. For expats living in Germany, here is a breakdown by nationality of the ID you can use to prove your identity to N26.

Video Identification. If eligible, the video ID verification will be done through the N26 app in partnership with IDnow, N26’s verification partner in Germany. For video identification, you will need:

Your supported ID (generally your Passport or ID Card but see here for the requirements for your nationality).

Your smartphone

To be in a quiet and well-lit room

Once you initiate the call in the N26 app, you will be connected to an N26 employee within a few minutes. Here you will be required to confirm your details and show your ID document to the camera. The N26 employee will check the different security features of your ID. All things going smoothly, the call will be completed in a matter of minutes and you will have completed your ID verification.

Step 4: Receive your N26 Debit Mastercard in the post

Your N26 Debit Mastercard will arrive in the post approximately 1 week after you have completed your ID verification.

You are now all set and ready to start using your N26 bank account.

N26 Review: Frequently Asked Questions About N26 Bank

1. Is N26 a legitimate bank?

Absolutely! Since being founded in 2013, N26 has expanded to 25 European markets and boasts over 5 million users. The bank has a full European banking licence.

2. Is my money secure with n26?

As well as adhering to all European regulations, N26 is also under the supervision of the Financial Markets Regulator. All N26 customers are covered by the German Deposit Protection Fund, which guarantees customer funds up to €100,000.

In addition, the N26 mobile and web apps can only be accessed via a secure login system. A 4-digit confirmation code must be entered each time you complete a transfer and push messages are sent for every payment going in an out of your account for added transparency.

3. How much does opening an N26 bank account in Germany cost?

N26's standard account is completely free to open and maintain. There are also no minimum income requirements and you do not need to make a deposit to open the account.

4. Will I be charged when using my N26 card overseas?

You will incur no foreign transaction fees when you pay for something overseas using your N26 Debit Mastercard.

5. Will the N26 app work on my smartphone?

You can download the latest version of the app on the Google Play Store or Apple App Store. If using an iPhone, you require iOS 11 or above and a Model 5s or newer. If using an Android, you require Android 6.0 or above.

6. How do I connect my smartphone to my N26 bank account?

When you start up the N26 app on your smartphone, you will be requested to confirm your phone number. You will then be required to enter a 4-digit code that N26 will send to you via SMS. And, hey presto, your phone is connected!

7. I need my IBAN and BIC, where can I find this?

The simplest way to find your IBAN or BIC is in My Account in the N26 app or web app. Here you will find both your IBAN and BIC listed.

8. How do I contact N26?

If you want to contact N26, then you can speak directly to an N26 agent via their chat function in the N26 phone app or in the N26 web app. If using the web app, the chat function is found in the bottom right-hand corner. If using the N26 phone app, access the chat function by selecting My Account > Help > Support Chat.

9. How do I change the password for my N26 account?

Either select Forgot? in the N26 mobile app or Forgot your password? in the N26 web app. N26 will then send you an email to create a new password.

10. How do I set a PIN for my N26 bank card?

Open the N26 mobile or web app and select My Account. Then select Card settings and choose the bank card that you would like to set a new PIN for. Select Reset PIN and enter the 10-digit number that is shown on your N26 bank card. Finally, choose your new PIN.

11. When will I receive my N26 bank card?

Once you have completed your ID verification, your N26 bank card will be immediately sent to you. Delivery times vary but generally are around 1 week.

If having an N26 card delivered in Germany, you must ensure that you specify the name on your letterbox when signing up for an N26 account.

12. How frequently can I withdraw cash for free using my N26 card?

In Germany, you get 3–5 free withdrawals per month.

13. I want to make a bank transfer. How long will this take with N26?

If you are making a domestic transfer or international SEPA transfer, then all transfers will be completed in 1–2 working days.

You can send money instantly to other N26 users if using MoneyBeam.

If using Wise (formerly TransferWise) to complete a foreign currency transfer, the transfer time will vary but you will be provided with an estimated transfer time.

14. What is my daily spending limit with an N26 account?

In Germany, you can withdraw up to €2,500 in a 24-hour period or spend up to €5,000 in-store or online. You can change these limits in the N26 mobile app.

15. How do I block my N26 bank card?

You can use the N26 mobile app to block your bank card at any time. In the app, select My Account > Card settings. From here, you can either disable online payments, overseas payments or cash withdrawals or you can opt to block your bank card completely.

16. What to do if your N26 bank account has been hacked?

If you suspect your N26 bank account has been compromised, then get in touch with them immediately via their chat function in the N26 mobile or web app. You can also request a callback in the chat function and N26 will get back to you within an hour.

I hope you have enjoyed this N26 review and that the sign-up instructions prove helpful. While N26 still has some teething problems as a young bank, I definitely think this is a fantastic option for newcomers to Germany.